International property consultant Knight Frank is reporting this week that the number of executives searching for rental properties is rising as the successful UK vaccination programme paves the way for a return to the office.

The new problem they face is a shortage of supply.

Family houses to let in prime locations in London and the south-east are increasingly scarce as owners decide to capitalise on a resurgent sales market. UK sales transaction numbers hit a 15-year high last month and prime markets were no exception. While there is a general over-supply of rental properties in London and the south-east, the same is not true for houses in prime locations with outdoor space.

A similar supply shortage has affected Premier League footballers and impacted the so-called super-prime £5,000+/week rental market in London.

In the corporate world, the shortage is most acute for houses between £2,000 and £4,000 per week. Tenants in this price bracket typically include European or North American families with one or both parents working in finance or tech. In-demand locations include Hampstead, Notting Hill, Kensington and parts of the Home Counties.

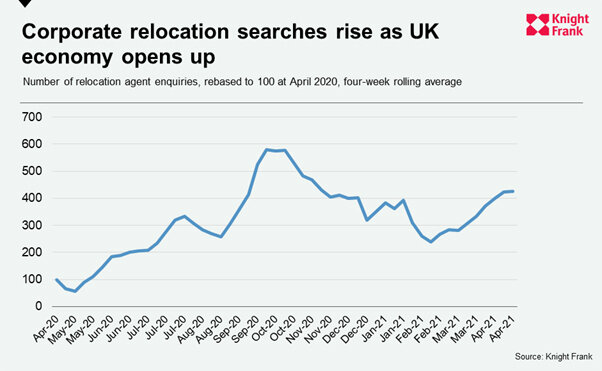

As the UK economy opens up following a third national lockdown, the number of searches by relocation agents is on the rise, as the below chart shows. The number is four times higher than April last year during the first national lockdown.

Such agents represent senior international executives moving to the UK with budgets typically up to £4,000 per week.

Meanwhile, listings data suggests a squeeze on supply, which will become more acute over the traditionally busy summer months ahead of the new academic year.

The number of house listings in this price bracket was 46.2% lower in March 2021 compared to the same month last year across London and the Home Counties. The number fell to 286 from 532, OnTheMarket data shows.

The shortage was most acute in the Home Counties, where lettings listings for houses between £2,000 and £4,000 per week fell to 6 from 36 in March last year.

While rental values fell by 14.3% in prime central London over the last year due to an influx of short-let properties on the long-let market, there is upwards pressure on rents for the most in-demand properties, said John Humphris, head of relocation and corporate services at Knight Frank.

“There’s a supply crunch coming down the line in prime lettings markets this summer,” said John. “Strong competition for the best properties is likely to push up rents. Unfortunately for some families it may mean one parent coming over to live in an apartment until a house can be found. Others may have to widen their search area or rent properties above or below their initial budget.”