Demand for prime properties with outdoor space has grown post COVID-19 outbreak

According to Knight Frank, country houses valued at £5m-plus saw the strongest price growth of any property type in the UK in the three months to June, due to interest in country living and the greater ability of buyers in higher-price brackets to transact.

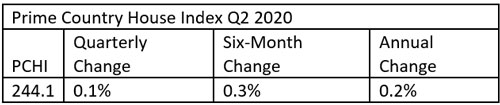

An increase of 1.2% was recorded in the second quarter of 2020 despite the fact property markets were closed between late March and mid-May as a result of the global pandemic. The overall Country House index was flat, as increased demand for outdoor space and greenery offset the impact of Covid-19.

“Buyers at the top end of the market have been willing and able to move quickly to secure their desired homes as lockdown restrictions have eased,” said Chris Druce, senior research analyst at Knight Frank.

“The relative scarcity of homes available at this price point can spark competitive bidding, which has put a degree of upwards price pressure at this end of the market.”

Prices have declined across UK markets during lockdown, which mirrors what has happened in prime London markets. However, higher-value properties outside of the capital have performed better due to the combination of growing demand for outdoor space and buyers who are in a financial position to act more swiftly.

Price growth for higher-value properties has also been weaker than the wider market in recent years due to a series of tax changes, leaving greater scope for future rises. While prices in England and Wales grew 22% in the five years to March 2020, the Knight Frank £5m-plus index fell 8.1%.

An analysis of offers accepted outside of London between 13 May and 24 June shows that the £5m to £10m price bracket has come back more strongly than the rest of the market. The number of offers accepted was 182% higher than the five-year average. This compared to 64% for all price brackets.

Furthermore, the number of new prospective buyers for £5 million-plus properties in country markets was 137% higher than the five-year average over the same period. Across all price brackets, the rise was 52%

“People are sensing an opportunity now,” said Edward Rook, partner in Knight Frank’s Country Department. “In the previous three or four years there have been consistent bumps in the road and the clear water people were looking for never came. We had that at last after the general election and then the lockdown came. People have simply decided it’s now or never.”